THE IMPORTANCE OF PRE-PLANNING A FUNERAL OR CREMATION SERVICE

Usually, the task of arranging a funeral falls to a couple of family members or a single survivor who may have little or no warning. These people are often unprepared for the many decisions that must be made. This is why pre-planning can be so important. It ensures your wishes are documented and can provide peace of mind for yourself and your family.

Affordable Direct Cremation Packages

Visit DFS Memorials to find locations and cremation prices in your province.

Pre-arrangement and pre-financing of funeral services can provide complete peace of mind and help relieve surviving families of the financial burden. A funeral can cost from a modest $3,000 for a simple cremation to over $15,000 for a full funeral service and burial.

Many families can struggle to come up with $3,000 unexpectedly these days, never mind $15,000. Even, if the deceased had money in their estate, often funeral expenses need to be met before the estate has been settled.

Making your wishes known in advance can do much to help loved ones carry them out. Discussing arrangements with your family is essential as the funeral affects them most directly.

It is also important that your family is aware that you have a pre-need funeral or cremation plan. So that they know who to contact when the time comes.

Here are some of the benefits of pre-planning funeral arrangements:

- You make rational decisions. Perhaps overcome with grief, someone else might find it difficult to make rational, logical decisions on your behalf.

- You may prepay expenses outright or in installments.

- A funeral paid for in advance of need can be a good investment. With today’s inflation rate moving ever upward, your costs are fixed.

- You eliminate the overwhelming decision-making process that can be left to your next of kin, enabling them to focus on coping with their grief without being overwhelmed by decisions.

Purchasing a Travel Protection Plan as part of a Funeral Plan

If you travel between the Provinces or outside of Canada, purchasing a Travel Assurance repatriation product can ensure you are covered should a death occur if you are away from your home.

A funeral or cremation plan may not always include expenses to repatriate remains if a person dies whilst travelling. It can cost thousands of dollars to bring a body back to Canada. And it can be a stressful and complicated process. A Travel Protection Plan can be purchased with a one-time payment of $450 for an individual for lifetime protection.

Your Plan covers all repatriation expenses for returning a body back to Canada or all expenses to conduct a cremation where the death occurred and transport the cremated remains home.

Learn more about the Travel Protection Plan.

Options for Pre-Planning a Funeral or Cremation

Setting up a Pre-need Plan with a Funeral Home

Licensed funeral homes all offer pre-arrangement services. Trained pre-arrangement professionals can guide you through the pre-arrangement contract and ensure you have put together a plan that covers all your needs. Funds paid to a funeral home for a pre-need contract are all put into a funeral trust to protect your money.

However, you should note that trust funds require maintenance and management, and you will make some contributions to your fund administration. There always remains a risk that a fund could perform badly and money could be lost.

Affordable Direct Cremation Packages

Visit DFS Memorials to find locations and cremation prices in your province.

Taking out Final Expense Insurance or Life Insurance

Another way to ensure you have made provision for your funeral needs is to take out final expense life insurance, sometimes referred to as funeral insurance or burial insurance.

This type of final expense life insurance policy covers your final expenses plus other expenses such as capital gains, estate taxes, and legal fees.

Life insurance can be used to cover funeral expenses but typically pays out on the policyholder’s death to support a surviving beneficiary. Some funeral homes will accept evidence of funds paid from a life insurance policy to secure a funeral contract.

Be wary of signing over a life insurance policy to a funeral home to cover funeral costs or even disclosing the full amount in the policy. The full funeral costs can amount considerably if it is perceived there are substantial funds to cover an extravagant funeral.

You can take out life insurance at any age, and the terms and payment will be assessed based on your age (life expectancy) and any existing medical conditions. Sometimes, seniors approaching their ‘twilight years’ tend not to apply for funeral insurance as they believe they will not qualify.

However, there are final expense options for the elderly that can be guaranteed to issue policies, so do not rule out obtaining funeral insurance if you are in your senior years.

The coverage on a funeral insurance policy usually ranges between $10,000 to $30,000, depending on your needs, your payment/s, and an assessment of coverage. The insurance agent will help you assess what amount you need to cover the funeral expenses you outline.

A family member is designated as a beneficiary to claim the policy and execute your final wishes. If you do not have a family member to assign to the policy, you can name someone you trust to fulfill your final wishes.

Creating your own Final Wishes Funeral Plan

The simplest way to start pre-planning is to create a final wishes plan to share with your family. This can even be part of making a will and estate planning. You do not necessarily need to put funds into a funeral trust or funeral insurance product.

You can put funds to cover a funeral into a Pay on Death (POD) bank account naming a beneficiary who can access these funds on your passing. This way, your money remains yours yet is instantly accessible to a trusted family member or other beneficiaries when the time comes.

Even websites will store data on your final wishes for you in our modern online world and share it appropriately with those chosen individuals you nominate.

How much Final Expense coverage do you need?

This will all depend on your funeral plan’s wishes. A basic direct cremation service can cost between $1,500 and $3,000 (in most cities). A cremation funeral or full traditional burial service will require funds to cover between $6,000 and $15,000.

This is why it is essential to outline your requirements so that you can prepare and break down the funeral costs.

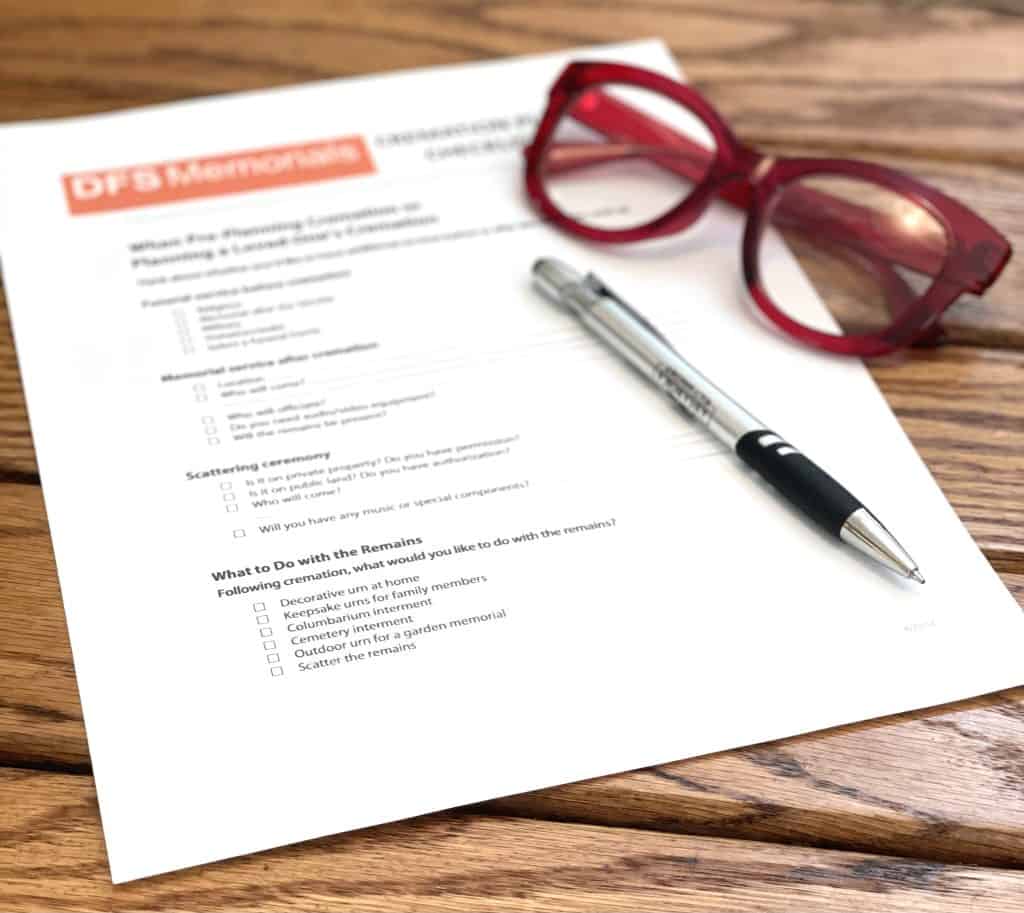

We have outlined below a simple Funeral Planning Checklist to help you get started.

Funeral Planning Checklist to Help Pre-Plan

Some questions to consider to help you plan your funeral needs.

- Do you want a cremation or a burial?

- Do you want a funeral service or ceremony before your cremation or burial? If so, what kind of service would you like?

- Do you want a visitation or viewing before a service or cremation?

- What kind of casket (if any) is required?

- Do you want to select an urn?

- Do you want to specify music for a service, hymns, clergy, or celebrant?

- Do you want someone specific to give a eulogy?

- If you opt for cremation, have you thought about the plans for your ashes?

- Do you have a cemetery plot or a cremation niche? If so, are the deed and details together with your funeral plan?

- Do you require the funeral home to provide funeral transport?

- Should flowers be sent, or would you prefer to request memorial donations?

- Do you want an obituary published? And, if so, in local press or online?

- If you are opting for burial, have you selected a headstone?

These questions above can help you form an outline of your funeral plan and get started. If you opt for a funeral service and burial, there will be more options to consider.

Taking time to pre-plan, record your wishes, and share them with your family can ensure everyone has peace of mind. No one likes to discuss death or end-of-life planning, but as something inevitable, your family needs to ensure they can be somewhat prepared to carry out your wishes.